The Tax Cuts and Jobs Act of 2018 and other tax reforms have brought about significant changes in the way that vehicle use is deducted for business purposes. Before getting into these changes, it is appropriate to first provide a review of the two methods for deducting the use of a business vehicle.

It is important to understand that both methods require keeping track of (1) the vehicle’s total annual mileage and (2) the vehicle’s annual mileage for business purposes. When using the optional mileage rate (also referred to as the standard mileage rate), only business miles are counted. When using the actual-expense method, the operating expenses and depreciation must be prorated based on the proportion of the total mileage that was for business purposes. To document the total mileage, deduct the odometer reading on the first day of the year from that on the last day of the year. For the business mileage, keep a daily record in an appropriate ledger. Keep in mind that the IRS states that all vehicles are used personally to some extent; it will look for a proration between business and (nondeductible) personal use.

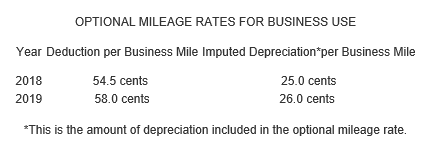

Optional Mileage Rates – The standard mileage rates for business use of a car, van, or pickup or panel truck are shown below:

However, a business cannot use the standard mileage rates if it has previously used the actual-expense method (via Sec. 179, bonus depreciation, or depreciation). This rule is applied on a vehicle-by-vehicle basis. In addition, the standard mileage rate for business use cannot be applied to any vehicle that is used for hire, such as taxi, or to more than four vehicles simultaneously.

Actual-Expense Method – Taxpayers always have the option of calculating the actual costs of a vehicle’s business use rather than using the standard mileage rates. Using the actual-expense method in the year when a vehicle is placed into business service may be worthwhile due to the potential for higher fuel prices, the extension and expansion of the bonus depreciation, or increased depreciation limitations for passenger vehicles as a result of the Tax Cuts and Jobs Act. Actual expenses include the costs of the following:

– Gasoline

– Oil and Other Fluids

– Lubrication

– Repairs

– Registration

– Insurance

– Depreciation (or lease payments)

– Interest

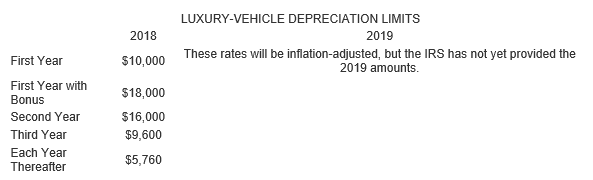

Vehicle Depreciation – The so-called luxury-vehicle rules limit the annual depreciation deduction for vehicles that weigh 6,000 pounds or less.

The recent tax reform substantially increased these limits by providing much larger first- and second-year deductions for more expensive vehicles. The table below displays the limits for vehicles that were placed into service in 2018. These rates will be adjusted based on inflation in future years.

The recent tax reform also included the option for the taxpayer to add a 100% bonus depreciation to the first-year luxury-vehicle rates (see the amount for “First Year with Bonus” in the table below). However, if a vehicle was purchased before September 28, 2017 (but was not put into service until 2018), the first-year depreciation cap with the bonus is reduced from $18,000 to $16,400.

Prior to 2018, the depreciation values for vans and light trucks were different from those for cars. In 2018, the depreciation limits are the same for both categories, but in future years, the limits may diverge because separate inflation adjustments will apply to the two categories.

SUVs – Because vehicles that weigh more than 6,000 pounds are not subject to the luxury-vehicle limits, the first-year deductions for such vehicles can be larger than those for smaller vehicles. The bonus depreciation for SUVs is 100% (through 2022), so the portion of the use that is for business can be fully expensed in the year when the SUV is placed in service. SUVs with gross vehicle weight of more than 6,000 pounds but less than 14,000 pounds are qualified for Sec. 179, which allows a business to expense up to $25,000 if the vehicle is placed in service during 2018 or $25,500 if it is put into service in 2019.

Interest Expenses – Self-employed taxpayers may also deduct the business-use portion of the interest paid on vehicle loans on Schedule C. regardless of whether they use the standard mileage rate or the actual-expense method.

Business-Vehicle Sales or Trade-ins – Under prior law, a good tax strategy was to trade in a vehicle instead of selling it if the sale would result in a gain, as this would defer the gain into the replacement vehicle and thus avoid tax on the gain. Conversely, it was good practice to sell a vehicle for a loss so as to take advantage of the tax loss. Unfortunately, since the recent tax reform, tax-deferred exchanges are no longer allowed, except for real estate. The aforementioned strategies are thus no longer valid, and all vehicle trade-ins are treated as sales: Any gain is taxable, and any loss is deductible. However, if a vehicle is used solely for personal purposes, a loss from a sale is not deductible; if a vehicle is used for both business and personal reasons, then only the business portion of a loss on a sale is deductible.

Employees – The recent tax reform also eliminated the itemized deductions for employees’ business expenses. Before 2018, employees could deduct the business use of their vehicles, but, starting with the 2018 returns, employees can no longer deduct business-vehicle expenses.

Plug-in Electric Vehicles – Purchasing a plug-in electric vehicle may qualify a taxpayer for a tax credit of up to $7,500 (depending on the manufacturer) in the year of the purchase. The credit for a given car is based on the kilowatt capacity of its battery; the full credit applies to the first 200,000 vehicles that each manufacturer sells, after which there is a phase-out regime. Tesla is the first manufacturer to enter the phase-out period, as it reached the 200,000-vehicle cap in 2018. Thus, the credit for 2019 is limited to $3,750 for Tesla vehicles acquired in January through June and $1,875 for those acquired in July through December. After 2019, there will be no credit for Tesla purchases. The amount of credit for each vehicle is available on the IRS’s website. Note that this credit is per vehicle, not per taxpayer, so a taxpayer who purchases multiple vehicles during a given year can claim the credit for each (subject to certain limitations).

When a plug-in electric vehicle is used for both business and personal purposes, its credit is prorated based on the mileage for each usage. The personal portion of the credit is a nonrefundable personal credit that cannot be carried over. The business portion of the credit is also nonrefundable, but it is added to the general business credit and can be carried backward for one year and forward for 20 years or until the credit is used up, whichever occurs first.

The tax rules for business vehicles can be quite complicated. To maximize your benefits, please contact our office for assistance.