As we approach 2025, major tax changes are on the horizon that could significantly impact estate planning. With the expiration of the Tax Cuts and Jobs Act (TCJA), estate tax exemptions could drop from $13.61 million per individual to between $5 million and $7 million — or even as low as $3 million. This upcoming change makes it essential for high-net-worth individuals and families to act now to maximize their estate planning opportunities.

What Is the Estate Tax Exemption?

The estate tax exemption is the amount you can leave to heirs without incurring estate taxes. Under the TCJA, this exemption doubled to $13.61 million per individual or $27.22 million per married couple. However, these figures are set to decrease sharply when the TCJA provisions expire at the end of 2025, making it critical to review your estate plan now.

Key Expiring Provisions of the Tax Cuts and Jobs Act (TCJA)

The TCJA brought significant changes to both individual and corporate taxes. Several of these provisions are set to expire in 2025, and the estate tax exemption is among the most impactful for wealthy individuals.

-

Estate Tax Exemption 2025 Changes

When the TCJA expires, the current lifetime gift and estate tax exemption could drop significantly. For high-net-worth families, this means losing the opportunity to transfer wealth to heirs tax-free at today’s higher exemption rates.

-

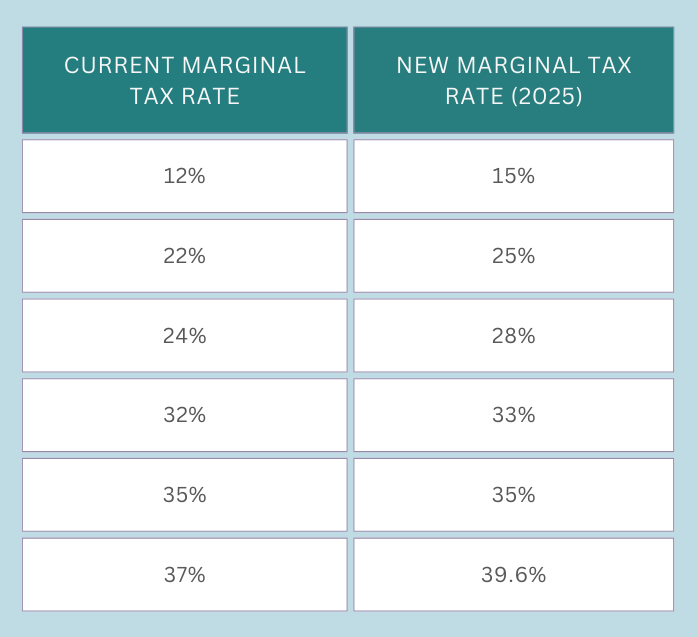

Marginal Tax Rate Comparison

The expiration of the TCJA will also bring a return to higher marginal tax rates. This will impact individuals with substantial income, increasing their overall tax liability.

-

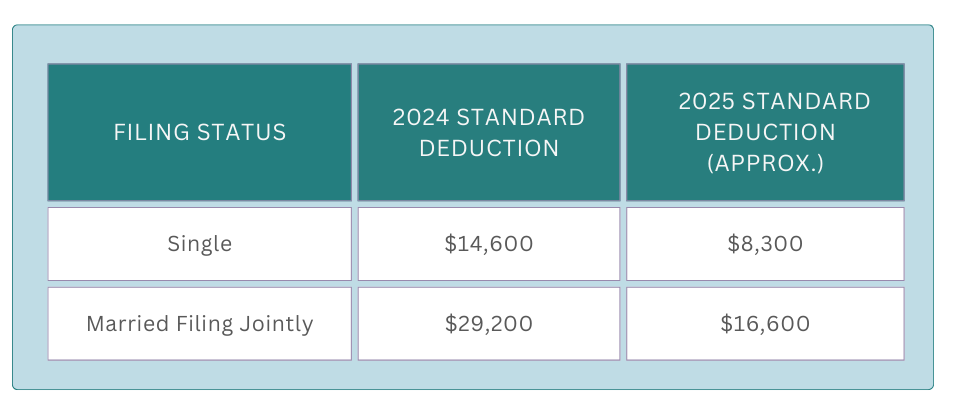

Changes to the Standard Deduction

The TCJA significantly increased the standard deduction, which reduced the number of taxpayers who itemize their deductions. However, when the TCJA expires, the standard deduction will be almost halved, leading many taxpayers to return to itemizing their deductions.

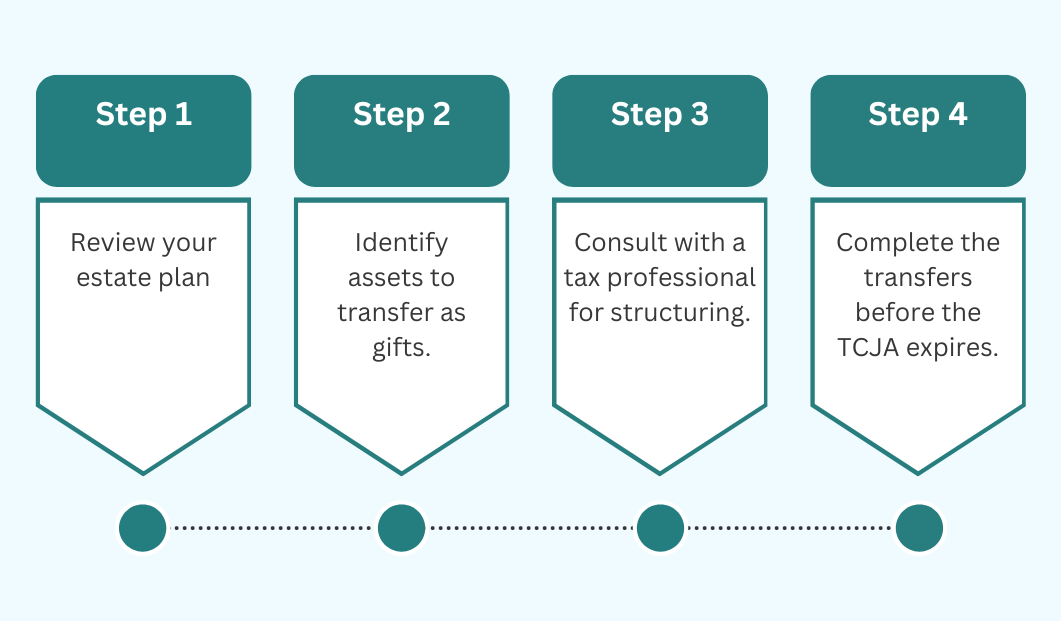

Estate Tax Exemptions 2025 – How to Plan Ahead for Changes

-

Make Use of the Current Exemptions

With the current estate tax exemption at its highest level, now is the time to consider making lifetime gifts to reduce your taxable estate. By transferring wealth before the exemptions decrease, you can potentially save millions in estate taxes for your heirs.

-

Prepare for Higher Income Tax Rates

With individual income tax rates set to rise, it’s important to consider accelerating income recognition while rates are still lower. For high-income earners, this could mean exercising non-qualified stock options, selling business assets, or making Roth conversions before the new rates take effect in 2025.

-

Leverage Charitable Giving and Trusts

Charitable trusts and donations can reduce the size of your taxable estate, while also supporting causes you care about. Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs) can be strategic tools to remove assets from your estate while providing for your beneficiaries.

-

Reevaluate Your Business Structure

The Qualified Business Income (QBI) deduction, which allows for a 20% deduction for pass-through income, will expire at the end of 2025. For small business owners, this deduction has provided significant tax relief, but it’s important to consider other structures to maintain tax efficiency when the deduction disappears.

How MeredithCPAs Can Help You Plan

Navigating the changes to estate tax exemptions 2025 requires expert guidance. At MeredithCPAs, we specialize in estate planning and tax strategy. We’ll help you:

- Analyze Your Current Situation: Understand how the new limits could impact your estate tax exemptions 2025.

- Develop a Strategy: Tailor a gifting strategy, set up trusts, or recommend other tax-saving techniques to protect your wealth.

- Stay Ahead of Changes: We will keep you informed on any legislative changes that may impact your estate plan.

Now is the time to take proactive steps to protect your estate and minimize your future tax liability. Whether it’s making strategic gifts, adjusting your business structure, or maximizing charitable giving, planning now can help you avoid unnecessary estate taxes down the road.

Need help navigating these changes? Contact MeredithCPAs today to ensure your estate planning strategies are optimized for the upcoming tax law changes.